Do you export to the U.S., and are you subject to U.S. taxes? You may be affected by the 2017 U.S. tax reform.

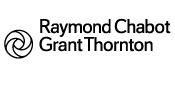

Before 2017, the U.S. corporate tax rate was one of the highest of OECD countries.

Until recently, Canadian businesses were not inclined to have a U.S. subsidiary. The primary reason for this reluctance to transfer profits and functions towards the U.S. was the corporate tax rate.

Before the tax reform, the U.S. corporate tax rate ranked last among the 35 OECD member countries. Before 2017, the average

[1] combined tax rate (federal and state) in the U.S. was approximately 35%, compared to an average of 26.5% for the other OECD member countries. This high tax rate was often considered an impediment to injecting capital into the U.S. economy and from a tax perspective, hampered the U.S.’s ability to compete with other world powers.

For example, a Canadian business that used a subsidiary to carry on activities in the U.S. could pay up to 64.6% of income tax[2]on these activities. As a result, it was more beneficial to limit activities and profits attributable to the U.S. subsidiary to stay within the lower-rate tax brackets.

Another Canadian business strategy was to forgo using a U.S. subsidiary to operate directly in the U.S. and limit activities in that country to representation, which made it possible to avoid U.S. federal tax. In this case, the maximum overall tax rate was 54.3%.

There was therefore a 10% difference between these two strategies, which explains why, to date, the second option was the one most commonly used. This finding aligns with the above comment on the U.S.’s tax competitiveness.

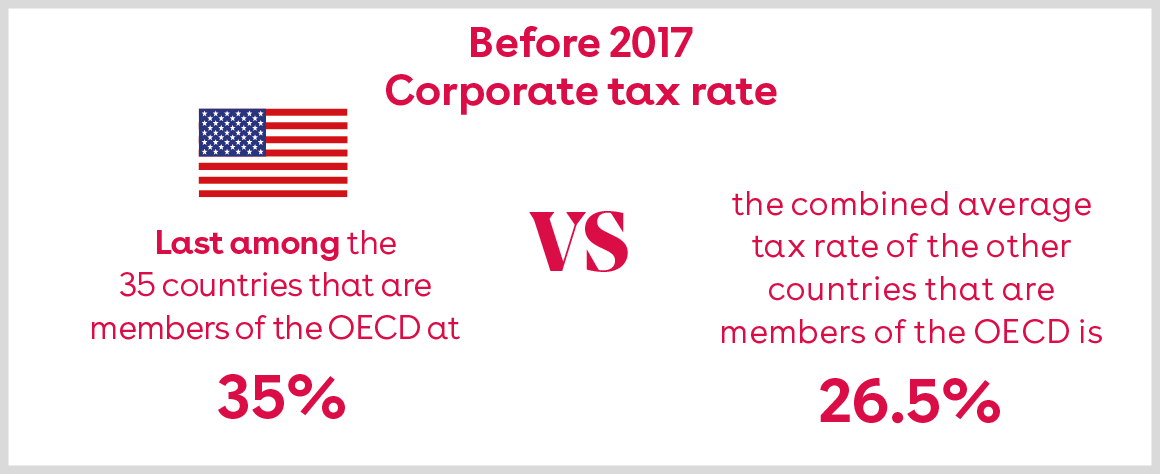

This tax reform reduces the tax rate considerably

The difference is major. The Tax Cuts and Jobs Act significantly reduces the corporate tax rate, from a bracket system with an average rate of 35% to a single rate of 21%[3]. Combined with state tax, the average corporate tax rate is now 25%. When compared with the Canadian tax system, the new U.S. tax rate compares with a Canadian tax rate without the small business deduction[4]of 26.8%.

As a result, this means that the overall tax rate, when using a U.S. subsidiary, is now 57.1%.

The tax reform has the following impacts for exporters:

- Exporters who already have a U.S. subsidiary could consider transferring more functions from Canada to the U.S. without having to worry about the impact of the corporate tax rate.

- For other exporters: the U.S. tax rate is no longer an impediment to expanding activities in the U.S. There is now no difference between using a Canadian corporation or a U.S. subsidiary.

In addition to the reduced tax rates that result in increased after-tax income in the U.S. subsidiary, the reform also provides for a number of other incentives to stimulate the U.S. economy:

- Higher capital cost allowance for most capital assets;

- Changes to the interest deductibility rules for some large corporations.

The U.S. has interesting market opportunities, and, since the tax reform, a very competitive tax system. An increasing number of Canadian companies will likely be attracted to this market. What about yours?

To find out more about Olivier Gariépy

[1] Under the pre-reform rules, the U.S. system was based on corporate tax brackets.

[3] There is a reduced rate of 13.15% for some foreign income.

[4] Taxable business income in excess of $500,000.